Understanding Shortage Allowances

read more

Federal agricultural agencies confirm that Brazilian maize production and exports soared to record levels last season, with a decline foreseen for the 2023/24 harvest amid adverse weather and ample inventories from competing global suppliers, followed by a recovery in 2024/25

Maize (corn) is among the most cultivated crops worldwide. A staple food, this versatile cereal is one of the grain cargoes most frequently carried by sea, typically aboard bulk carriers.

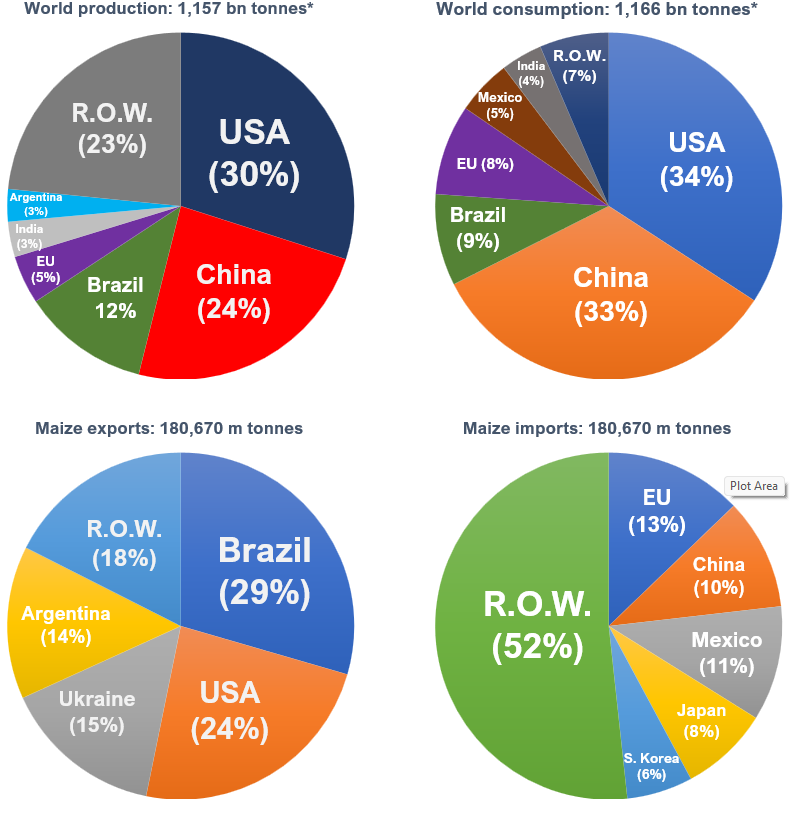

The United States and China are the top producers, consumers and suppliers of maize, followed at a distance by Brazil, the European Union, Argentina and India. Besides China and the EU, major traditional importers include Mexico, Japan, South Korea, and Vietnam.

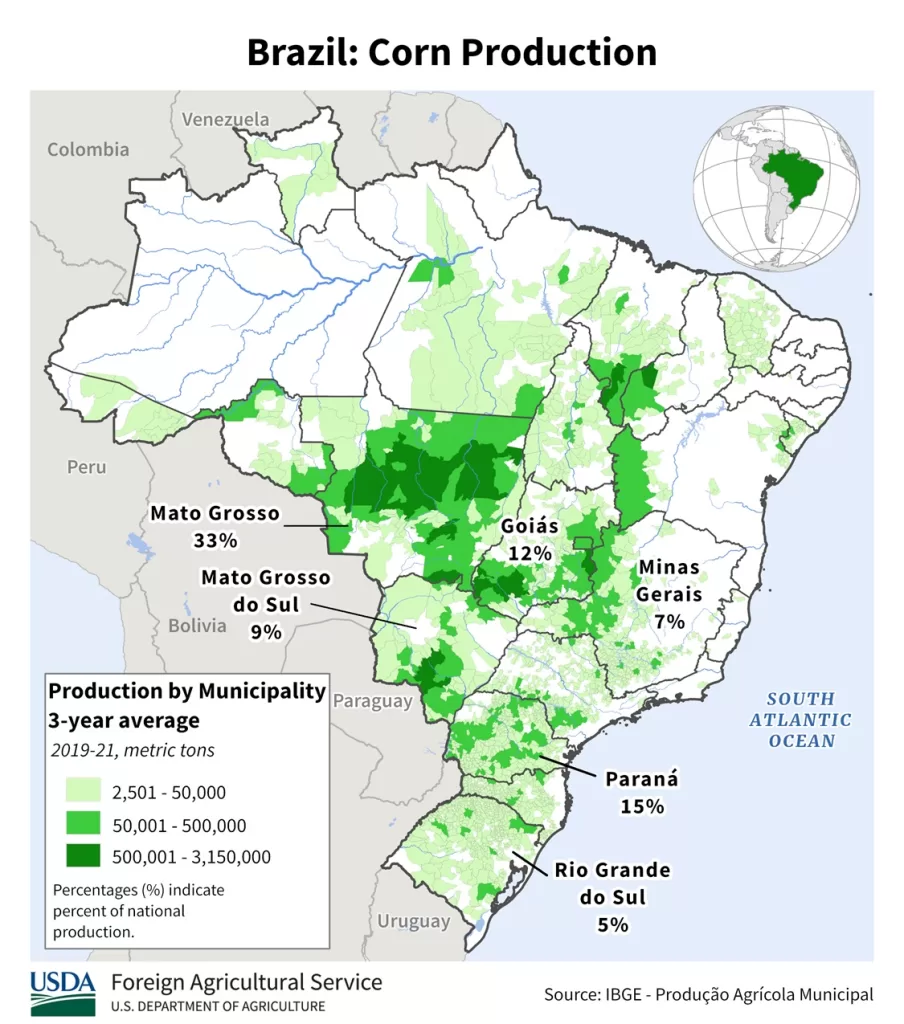

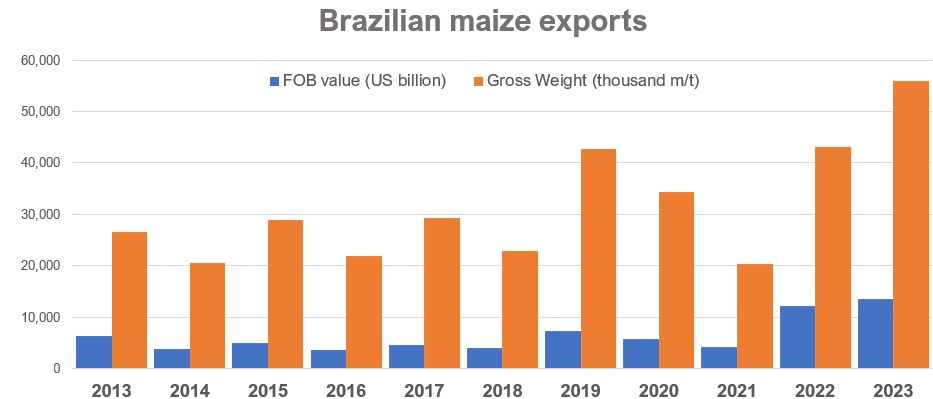

Brazil is a key global player in this trade, having harvested 12% of world production in the 2022/23 season and shipped 29% of all world exports in that cycle. Figure 1

As the 2022/23 season comes to an end, the United States Department of Agriculture (USDA) estimates that global maize production will have decreased by around 5%, from 1,22 billion tonnes to 1,16 b tonnes, with exports falling by 7%, from 193,5 million tonnes in 2021/22 to 180,7 m tonnes in the current season.

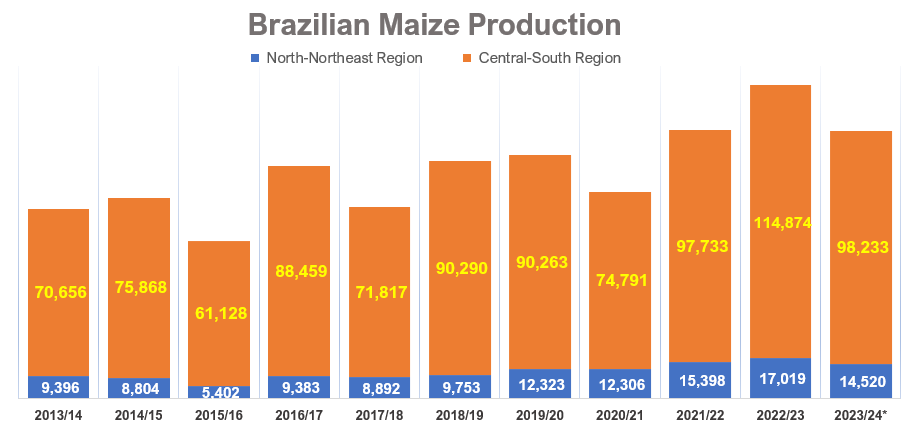

In the opposite direction to the drop in world supply, Brazilian maize reached a record harvest of 137 million tonnes, an impressive increase of 18% compared to the previous cycle, behind only the US and China.

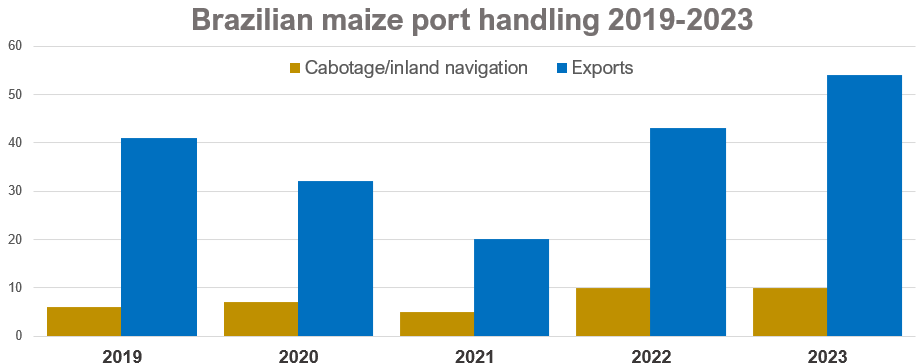

Unlike its main competitors in the global maize market, the USA and Argentina, which consume most of their output for crushing (for oil extraction, feedstuff and biofuels), Brazil tends to ship nearly half of its inventories abroad in bulk or mealy form. Indeed, in 2022/23, it surpassed the USA as the largest maize exporter for the first time, having shipped 53.3 million tonnes in the last season, a staggering growth of 67% compared to 2021/22 figures. Figure 1

A Protocol on Phytosanitary Requirements signed in May 2022 between Brazil’s Ministry of Agriculture, Livestock and Supply (MAPA) and the General Administration of Customs of the People’s Republic of China (GACC), boosted Brazilian maize exports to China, the world’s largest soya bean buyer (primarily sourced from Brazil) and top producer and consumer of maize after the United States.

The agreement is already reshaping traditional global maize trade flows. Over the past two years, China has purchased more from Brazil than from its regular suppliers and is likely to become the world’s biggest maize importer, along with the European Union.

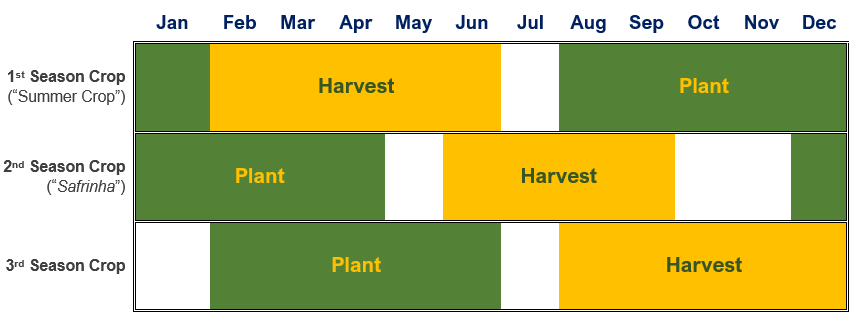

As a warmer climate crop, maize production is typically linked to spring and summer. Nevertheless, given Brazil’s diverse soil and climate across the tropics, it cultivates the grain throughout the year over three cropping cycles, either in dedicated fields or alternating with other cultures.

The maize crop calendar varies considerably from region to region and season to season over the year’s three crops. Of course, the cereal needs favourable conditions throughout its vegetative cycle, and its planting and harvesting are directly influenced by adverse weather and economic factors. Figures 2 & 3

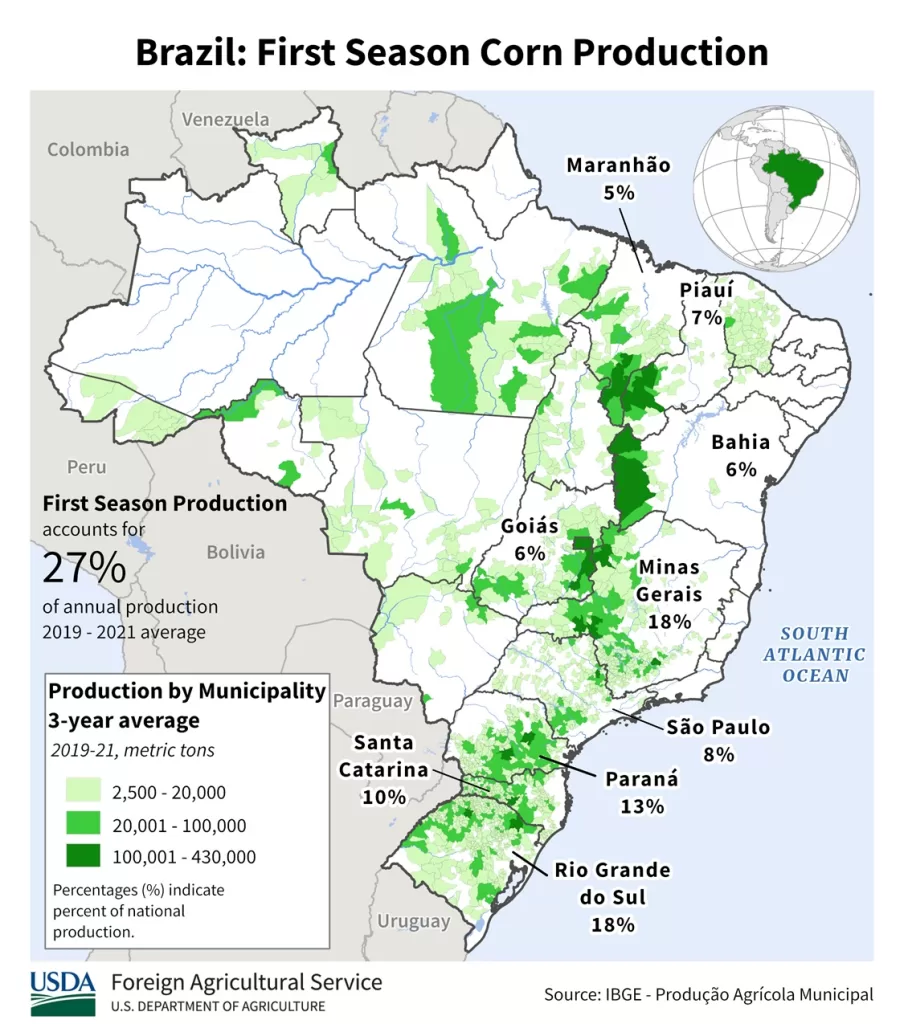

First-season maize crop, colloquially called “summer maize”, is cultivated in almost all regions, mainly in Southern and Southeastern states, such as Minas Gerais, Paraná, and Rio Grande do Sul. It also expands towards Northeastern states, including Bahia, Piauí and Maranhão, and is typically planted from August to December and harvested between January and June. The first-season crop represents about a fifth of national maize production, according to recent crop assessments by CONAB.

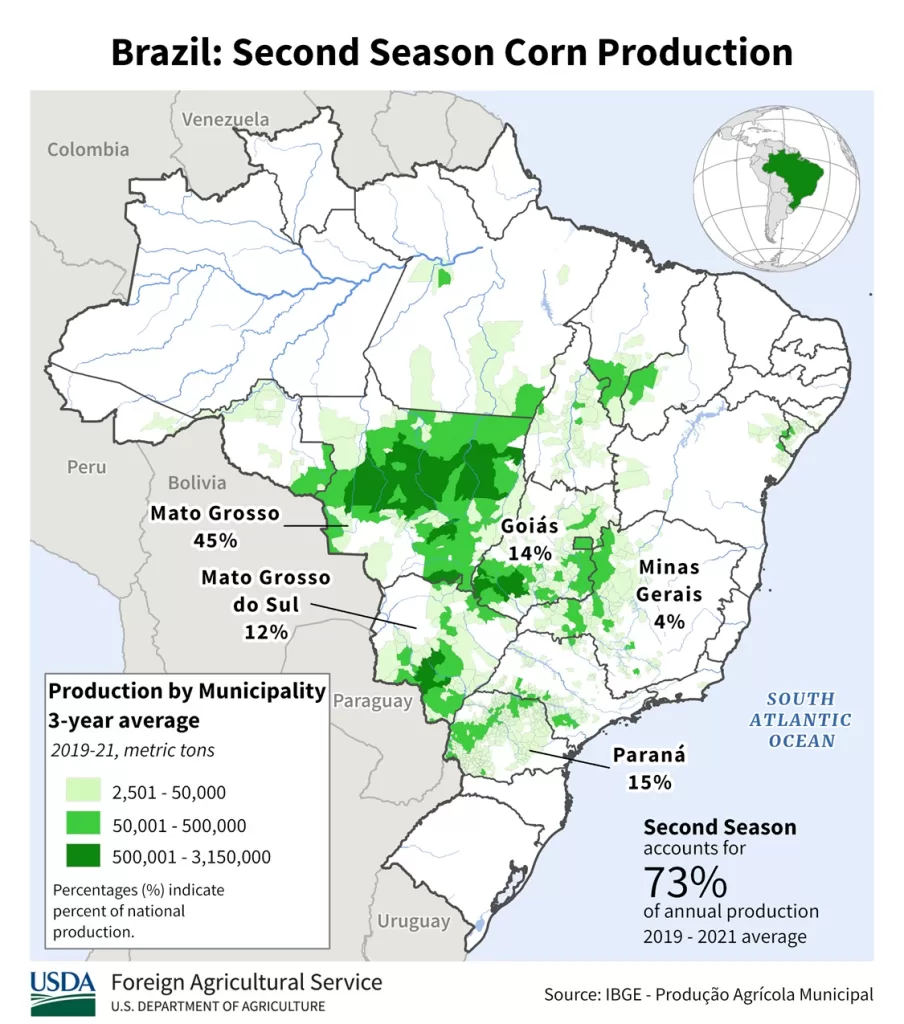

Known as “safrinha” (little harvest, in Portuguese), the second-season maize crop is sown from December to March, typically after the soya bean harvest in some regions. Despite its diminutive adjective, it occupies the largest planted area, accounting for nearly three-quarters of the country’s maize yearly throughput. Safrinha is grown primarily in the Central-West states of Mato Grosso, Mato Grosso do Sul and Goiás, and the Southern state of Paraná.

A few years ago, Brazilian growers introduced an incipient third-season maize crop in some states in the North and Northeast regions. The crop cycle typically lasts from May to October, and yields are modest compared to the first and second seasons’ yields. The Northeastern states of Bahia, Sergipe, and Alagoas stand out in this cycle.

After soya beans, maize is Brazil’s most cultivated and exported agricultural product. As with any other grain commodity, the main factors driving the size of the planted area are production costs, expected yield, and profit margins compared to other highly profitable crops, such as soya beans. Figure 4

In the Brazilian port system, maize is the third busiest solid bulk cargo, after iron ore and soya beans. Since it is grown in three annual crops, shipments of this commodity leave Brazilian ports throughout the year. At certain times of the year and in some ports, maize competes with soya beans and sugar cargoes for onshore storage space and loading berths. Port congestion is common during peak grain export season in busy bulk ports such as Santos, Paranagua and Rio Grande.

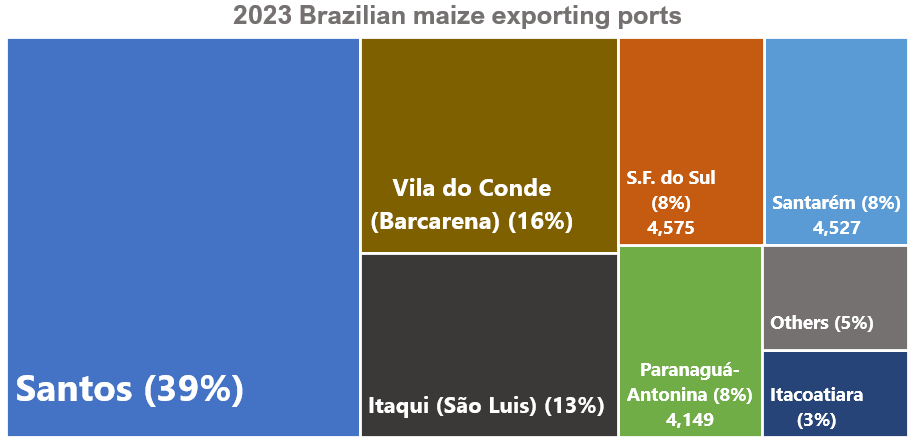

As usual, the largest port in Latin America, Santos, stood out as the main maize exporting port complex, having shipped more than 2,4 million tonnes in 2023, corresponding to 39% of all volumes exported last year. The Northern Arc ports (Itacoatiara, Santarém, Vila do Conde/Barcarena, Santana/Macapá, and Itaqui) performed outstandingly, collectively contributing 40% of last year’s maize export volumes despite the severe drought that plagued the inland waterways of the Amazon in the second half of last year. Figures 5 & 6

Last year, maize ranked fifth in Brazil’s exports in terms of FOB sales and occupied second place in the ranking of agribusiness exports.

Around 53% of all maize exported through Brazilian ports in 2023 was produced in the powerhouse grain state of Mato Grosso, followed by the states of Goiás (9.7%), Paraná (9%) and Mato Grosso do Sul (7.2%). The main buyers of maize from Brazil last year were China (27% of all shipments), Japan (11%), Vietnam (8.3%), South Korea (6.4%) and Iran (6.1%). Figures 4 to 7

The USDA expects maize production and exports to reach high levels with a significant recovery. For the ongoing 2023/24 season, the agricultural agency estimates that global maize output will rise 6.5% to 1.2 billion tonnes, while exports will arrive at 198 million tonnes, a growth of 9.3% over the previous season.

On the other hand, the USDA projects that the Brazilian maize harvest in the 2023/24 season, which kicked off last month, will fall about 10% (from a record-breaking 136 m tonnes down to 122 m tonnes), with exports remaining at around – or slightly below – previous levels, that is, 53 m tonnes. Among the factors highlighted to explain the decline that followed last season’s bumper crop is the negative impact of El Niño at different periods of the maize growing cycle, the migration of farmers to more profitable, and stiff competition with other global suppliers.

Due to maize’s relevance for the national feed and ethanol industries, the US agricultural agency expects Brazilian producers to resume interest in the cereal, which can be planted three times a year. Demand will likely remain high, especially from China, with a predicted increase in production to around 129 m tonnes in the 2024/25 season, as the adverse weather phenomenon that has plagued this crop will have already passed.

With a more pessimistic forecast, CONAB foresees that domestic maize production will fall to 113 m tonnes due to unfavourable weather coupled with the downsizing of the planted area to make way for competing crops or prepare the land for the abundant safrinha.

In sharp contrast to the projections of its US counterparts, for 2023/24, CONAB expects a substantial increase in maize imports (to offset lower yield prospects), with exports reaching 32 m tonnes, 41% less than the volume for 2022/23, amid greater availability on the international market, particularly after good harvests in the USA and Argentina.

Problems with maize cargoes often arise before loading operation begins, including missing or inaccurate shipper’s declaration of cargo information or cargo holds and hatch covers not passing pre-shipment inspections due to not meeting cleanliness standards or failing hose or ultrasonic weathertightness tests by charterers and cargo interests.

As with any other grain that has not undergone a mechanical or chemical extraction process and is transported in bulk in large volumes, maize is prone to biological decomposition in the face of high moisture content and temperature. These two factors can drastically shorten the grain’s shelf life and ultimately trigger microbiological or weather-related cargo damage during sea carriage in the form of condensation, self-heating, infestation, caking, and mould, which can produce high concentrations of aflatoxins harmful to human and animal health.

According to the official grading standard of the Ministry of Agriculture, Livestock and Supply (MAPA), which only applies mandatorily to maize imports for domestic consumption (or where the Brazilian government is the buyer or seller), the technically recommended moisture content limit for safe storage of maize is 14%. On the other hand, the standard sales contracts drafted by the National Association of Grain Exporters (ANEC), widely adopted by traders exporting from Brazil, provide for a maximum moisture of 14.5%, with grading carried out following MAPA’s grading standard.

Other types of physical damage to maize shipments are caused by ingress of rain or seawater (from a leaky hatch cover or bilge or during loading operations), debris, or contamination with other cargoes previously handled by the port facilities, as well as living or dead insects, birds and rodents. As a valuable solid bulk commodity, maize is also subject to shortage claims.

The SOLAS Convention generally governs the carriage of maize in bulk. Although it is a solid bulk cargo, maize is not scheduled in the IMSBC Code. Instead, it is covered by the International Grain Code and the BLU Code, whose guidelines and instructions must be strictly followed by shipmasters and crews loading grain cargoes.

Given the sensitivity of maize and the risks of cargo damage or shortage, shipowners and charterers would not go wrong appointing trusted local surveyors to assist the master and crew before, during and after completion of the loading, including tasks such as:

Carriers should consider appointing reliable surveyors at discharge ports to unseal the holds and provide certification, carry out initial and final draft surveys and assist the master should there be any signs of cargo deterioration during the voyage.

While the above measures may not eliminate the risk of a cargo claim, they would undoubtedly provide sufficient information to enable carriers and their P&I insurers to mitigate losses.

Please read our disclaimer.

Related topics:

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br