Understanding Shortage Allowances

read more

Despite a drop driven by adverse climate phenomena and other factors, the country yields its best harvest after last year’s bumper crop

The National Supply Company (CONAB) predicts a grain harvest of 299.3 million metric tons (mmt) for the current crop, which is nearing its end. Concerning the country’s two main agricultural products, CONAB predicts an overall reduction of about 12% in corn (maize) production compared to the previous season’s bumper crop. Additionally, soya bean harvest is anticipated to experience a 4.7% decline compared to the record output achieved in the 2022/23 season.

These results are considered satisfactory by the federal agriculture agency, given the climatic extremes that impacted several important producing areas at different stages of crop development.

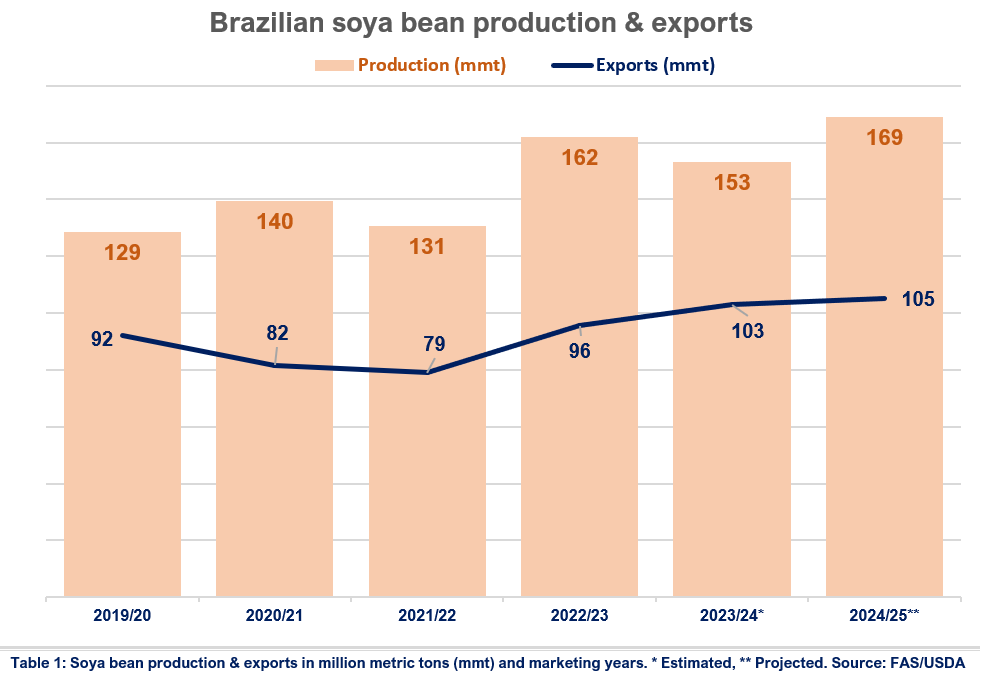

Despite a 4.4% increase in planted area, CONAB estimates that soya bean production will close at 147 mmt, 4.7% less than the previous cycle. The US Department of Agriculture (USDA) also lowered its estimates for the Brazilian soya beans to around 153 mmt due to severe flooding in Rio Grande do Sul, a grain powerhouse state, lower yields in other producing states and declining international prices. Even so, that would be the second-largest soya bean production after the 2022/23 season. (Table 1)

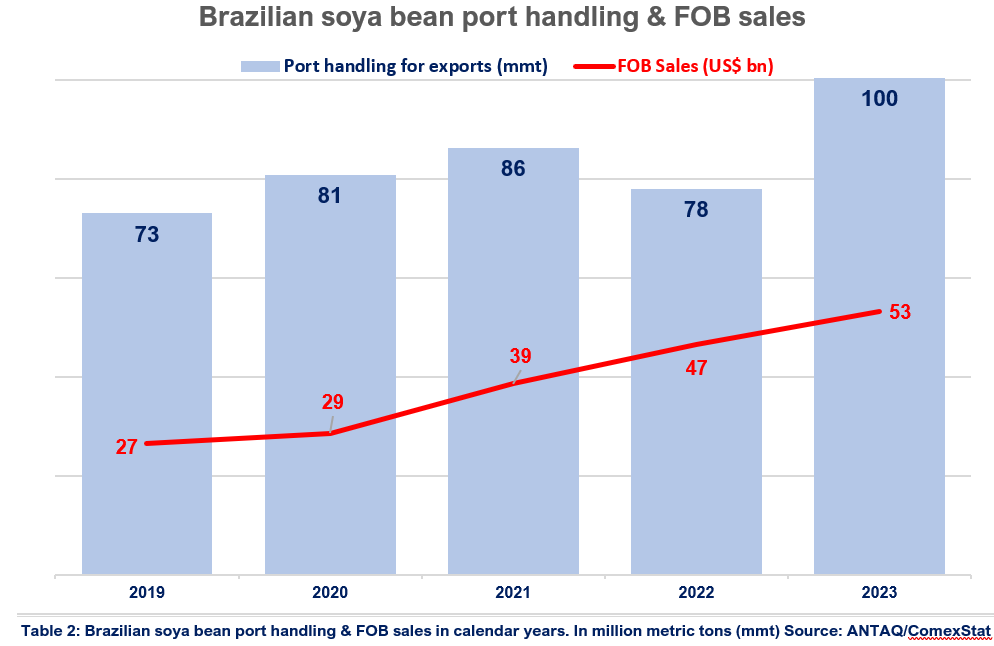

Soya beans remain the top commodity in Brazil’s export basket, bringing in USD 53.2 billion in the last calendar year and accounting for 16% of all export revenues. In the previous marketing year (October 2022 to September 2023), Brazil shipped 95.5 mmt of soya beans abroad, keeping the oilseed the second-largest export commodity in gross weight after iron ore.

Despite the floods in Rio Grande do Sul and adverse weather in key producing regions, the USDA estimates that Brazilian soya bean exports in the 2023/24 season will reach an unprecedented 103 mmt, driven by heated international demand.

Following the trend of recent years, nearly three-quarters of all soya beans exported in 2023 went to China, followed by Argentina, Spain, Thailand and Turkey. Brazil and China remain the world’s largest oilseed suppliers and buyers.

According to statistics from the National Agency of Waterway Transport (ANTAQ), from January to December 2023, a record 100 mmt of soya beans in bulk were shipped abroad. About 16% of this volume was pre-carried in barge convoys between cargo transhipment stations and the grain ports on the Amazon inland waterways. (Table 2)

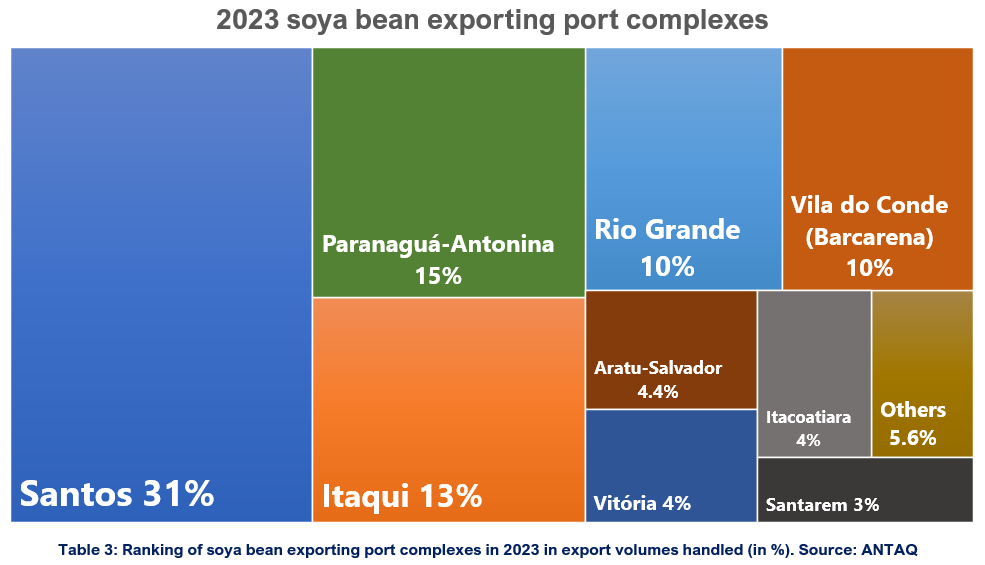

Following the trend, soya bean shipments peaked between March and June. The main port complexes for soya bean exports in 2023 were Santos, which shipped 30.6 mmt (31%), Paranaguá-Antonina, with 14.5 mmt (15%), Itaqui, with 13 mmt (13%), Rio Grande, with 10 mmt (10%), and Vila do Conde-Barcarena, with 9.9 mmt (9.9%). (Table 3)

Last year, 64% of all soya bean shipments leaving Brazil were destined for China, followed by Singapore (10%), Spain (2.6%), Thailand (2.5%), Argentina (2.4%) and Turkey (1.9%).

Although CONAB’s projections for the upcoming season have not yet been released, the US agricultural agency anticipates that the Brazilian soya bean harvest will reach an unprecedented production of 169 mmt, with a record 105 mmt to be exported, primarily to China, which, in turn, is forecasted to import record volumes in the outyear.

Given its diverse soil and climate, Brazil grows corn over three annual cropping cycles, with varying harvest calendars across regions and seasons.

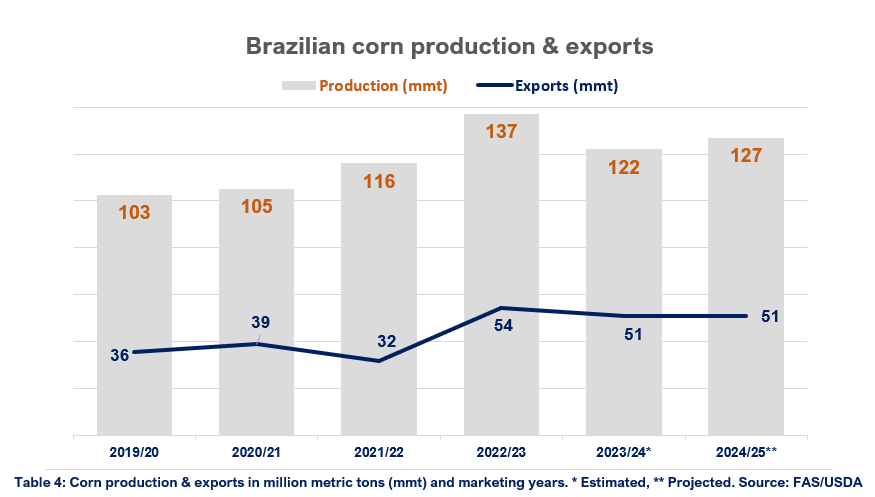

In the 2022/23 season, the Brazilian corn harvest reached an unprecedented 131 mmt, behind the United States and China, the world’s top producers and suppliers. On the other hand, for the current season, CONAB estimates that combined crops will yield about 116 mmt, 12% less than the past season, due to a reduction in planted area and lower productivity.

With a more optimistic outlook, the US Department of Agriculture (USDA) estimates that corn production in the 2022/23 season will close at a staggering 137 mmt harvested, while the 2023/24 season should reach a production of 122 mmt. (Table 4)

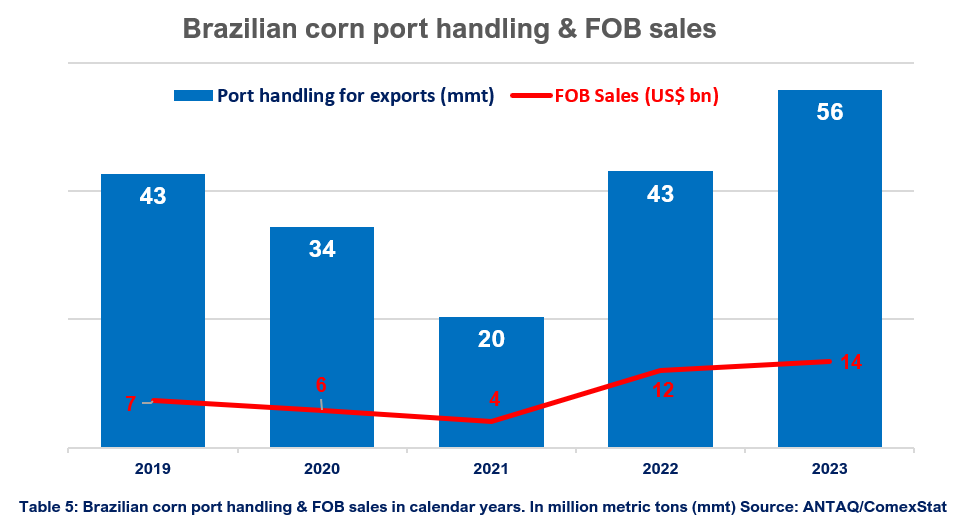

Corn is the most cultivated and exported agricultural product after soya beans. The versatile cereal grain is the fifth most profitable export item in the Brazilian trade balance, with 55 mmt exported between January and December 2023 and FOB sales reaching a record USD 13.6 billion, chiefly to China and other Asian markets. (Table 5)

The USDA estimated Brazilian corn exports in 2023/24 to reach 122 mmt, the second-highest export volumes to date.

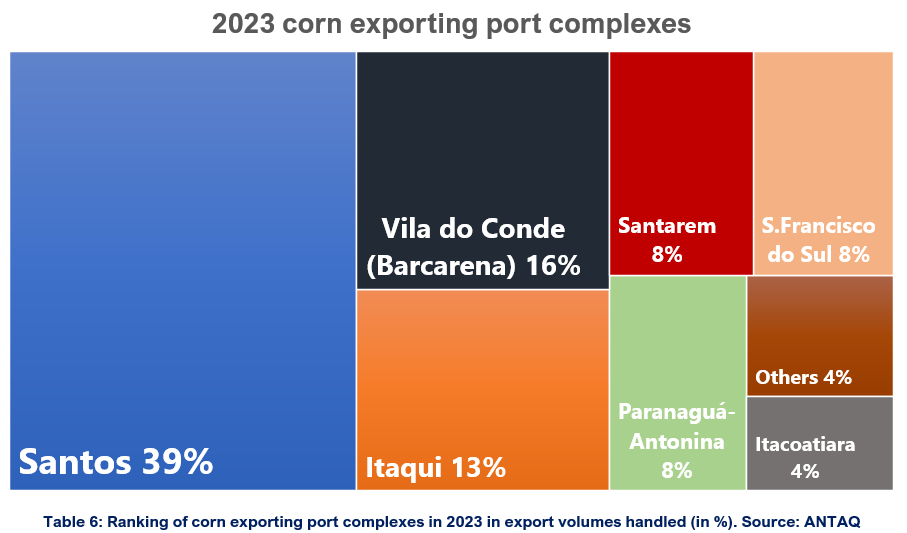

Statistics from ANTAQ indicate 56 mmt of corn were exported from Brazilian ports, with about 36% of that quantity transported on barges from cargo transhipment stations to grain ports along the Amazon River and its tributaries. The majority of the shipments departed between July and early January from Santos, which shipped around 39% of all corn exports last year, followed by Vila do Conde (Barcarena) (16%), Itaqui (13%), São Francisco do Sul (8.4%), Santarem (8.3%) and Paranaguá-Antonina (7.6%). (Table 6)

Approximately 29% of Brazilian corn exports were bound for China, and other relevant destinations included Japan (9.6%), Vietnam (8.3%), South Korea (5.2%) and Iran (5.2%).

The USDA estimates that Brazilian corn production will recover from the negative impact caused by El Niño and the catastrophic floods that devasted Rio Grande do Sul, the largest national rice producer and the leading producer of first-season corn (the first out of Brazil’s annual three crops). It projects an increase of corn output to 127 mmt following an expected rise in consumption, especially by the feed and biofuel industries. In this scenario, the US agricultural agency predicts that corn exports in 2024/25 will reach 51 mmt, the second-best corn production and export season ever.

Overall, the agricultural sector in Brazil continues to play a crucial role in the country’s economy, with soya beans and corn being key contributors to keeping a positive balance of trade despite challenges from adverse weather and other factors.

Please read our disclaimer.

Related topics:

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br