Understanding Shortage Allowances

read more

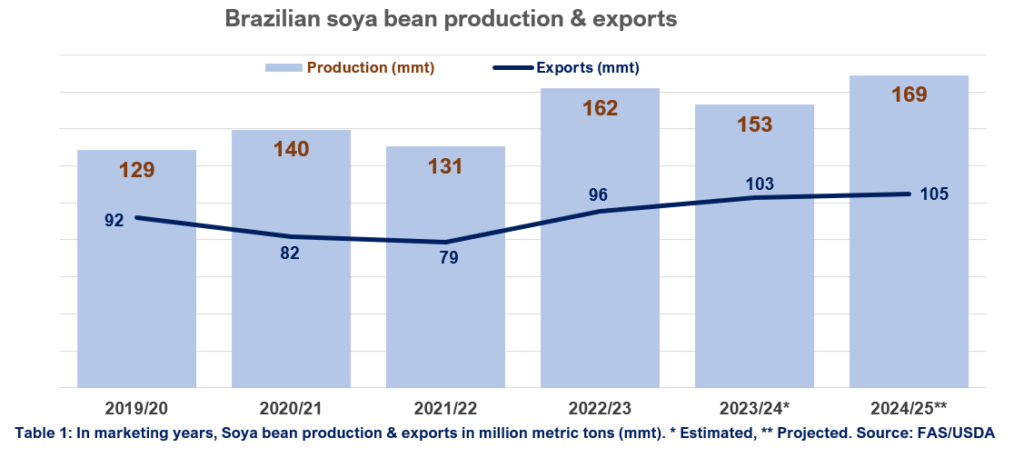

Despite challenging weather and climate conditions in key producing regions, soya bean production and exports remain high and are expected to reach record levels in the 2024/25 season

As the current soya bean harvest drew to a close, the National Supply Company (CONAB) estimated production of 147.4 million metric tons (mmt), making it the second-largest soya bean season in history, only after the 2022/23 bumper crop. This 4.7% drop from last season’s record harvest was achieved amid adverse weather events at critical stages of the crop, including delayed rain, low rainfall, and high temperatures in important producing states in the Central-West and Southeast regions, and the Matopiba (an agricultural region comprising the northeastern states of Maranhão, Tocantins, Piauí and Bahia).

In contrast, the United States Department of Agriculture (USDA) forecasts a more optimistic outlook for this Brazilian soya bean season, predicting that production will reach 153 mmt, far surpassing leading competing producers – the United States with an output of 113 mmt and Argentina with 48 mmt.

Despite massive floods in Rio Grande do Sul and dry weather in key producing states in central Brazil throughout the crop development, in its latest assessment the past week, CONAB considered the outcome of the 2023/24 season soya bean harvest satisfactory. The federal agricultural agency anticipates that 92 mmt of the oilseed will have been exported during the 2023/24 marketing year, contributing to the ample global ending stocks of the commodity during this season and the next – and exerting further pressure on prices. At the same time, the USDA estimates 2023/24 Brazilian soya bean exports to reach a record 105 mmt, well ahead of the USA (46 mmt), Paraguay (7.6 mmt), and Argentina (7.6 mmt). Table 1

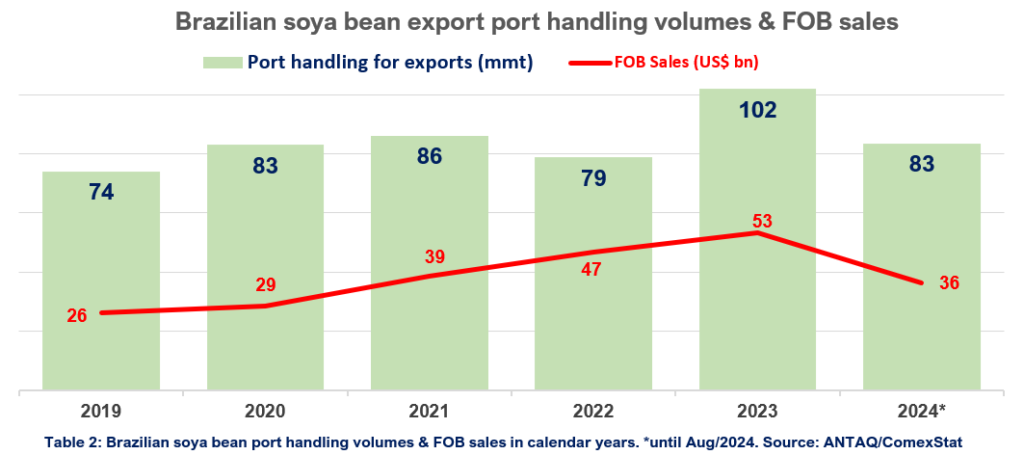

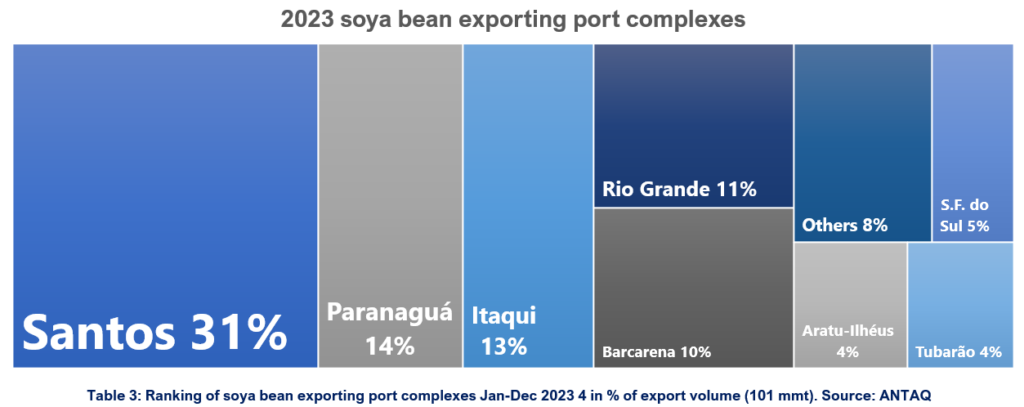

According to the National Agency of Waterway Transport (ANTAQ), in 2023, a record 100 mmt of soya beans in bulk were shipped from Brazilian ports, 29% more than the previous year. Around 16% of the oilseed was pre-carried in barge convoys from cargo transhipment stations in Porto Velho, located on the Madeira River, and Miritituba (Itaituba), on the Tapajós River, to grain ports downstream the Amazon River, despite the severe drought that plagued these crucial inland waterways last year. Tables 2 & 3

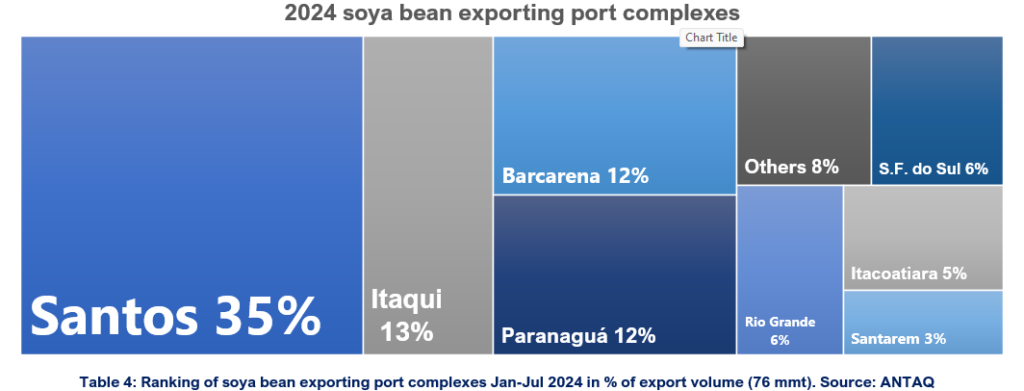

The latest statistics from ANTAQ indicate that from January to July, approximately 76 mmt of soya beans were shipped from Brazilian ports, marking a modest 4% increase year-on-year. The top soya bean exporting ports during this period were Santos (handling 35% of the volumes), Itaqui (13%), Barcarena (12%), Paranaguá (12%), São Francisco do Sul (6.3%), and Rio Grande (6%). Tables 2 & 4

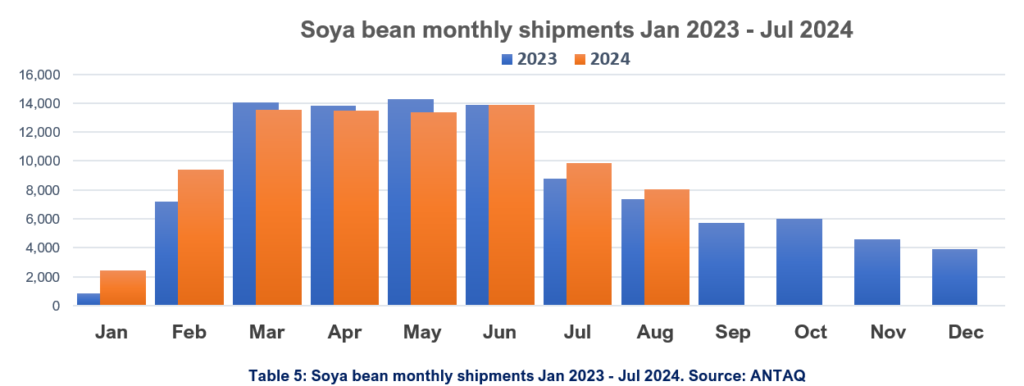

Shipments departing from Brazilian ports in the first half are consistent with the monthly port handling recorded during the same period in 2023. According to estimates by the National Association of Grain Exporters (ANEC), based on the line-up of ships fixed to load soya beans in September, the volume shipped will be around the same as last year. Table 5

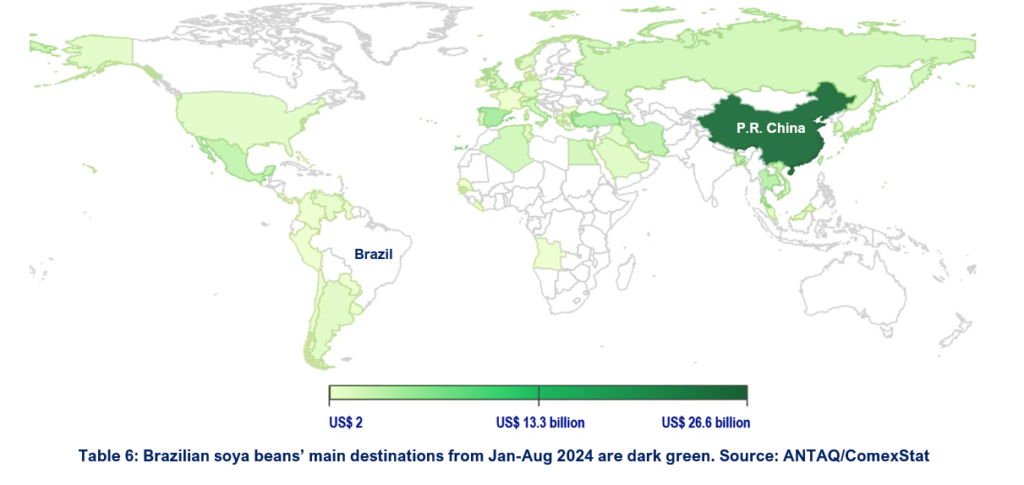

In line with the sales trend of the last seasons, around 73% of all Brazilian soya bean shipments from January to August 2024 were destined for China, followed by Spain, Turkey, Mexico, and Iran. Table 6

Despite challenging weather and climate conditions, the outlook for the 2024/25 soya bean season is promising. The USDA projects that the global soybean harvest for the upcoming season will be the largest in history, reaching an unprecedented 429 mmt. Brazil is expected to contribute around 40% of this record output and nearly 60% of all soya bean exports. China remains the world’s largest soya bean consumer, buying about one-quarter of global production.

While CONAB’s projections have not been released yet, its US counterpart anticipates that Brazil will harvest a record 169 mmt in the 2024/25 soya bean crop. This volume represents an impressive 11% increase compared to the current season despite a late kickoff due to dry weather and wildfires in key producing states. The US output, in turn, is expected to yield 125 mmt, followed by Argentina with a harvest of 51 mmt.

Most producing regions are approaching the end of the so-called ‘vazio sanitário’ (sanitary void), a three-month period during which no live soya bean plants are permitted in the fields to control pests and disease infections, such as the soya bean rust. According to the sowing calendar for this crop, drawn up by the Ministry of Agriculture and Livestock (MAPA), soya bean planting in the leading producing states starts this month and ends in late January 2025.

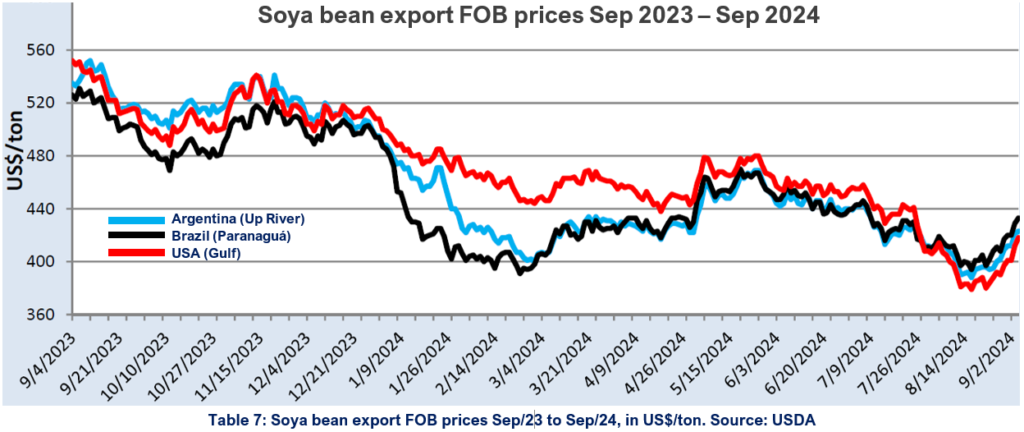

Agricultural agencies and market analysts predict that the global oversupply of soya beans may exacerbate the decline in already low prices on the international market. Nevertheless, the oilseed will remain the most profitable crop for farmers and traders. It will also continue to drive the Brazilian trade balance surplus as the country’s top export item in FOB sales, second only to iron ore exports in gross weight shipments.

Brazil is expected to retain its position as the world’s top soya bean producer and exporter, even amid ongoing climate change and potential trade implications from environmental legislations such as the EU Regulation on Deforestation-free Products (EUDR), while substantially expanding its share of the global maize (corn) market in the years to come. Table 7

The Amazon River and its tributaries are experiencing historically low water levels due to its worst drought. The unprecedented dry weather severely impacts riverside communities and commercial navigation, critically hindering the flow of agriproducts for export through the Amazon inland waterways. At the same time, widespread wildfires are raging in the Pantanal region and the savannah Cerrado biome across the Central-West region, affecting key grain-producing states, including Mato Grosso, Mato Grosso do Sul, and Goiás. Both spontaneous and human-ignited fires also strike the Southeast region, impacting sugarcane plantations in São Paulo and Minas Gerais and potentially disrupting sugar and ethanol production.

The immediate consequence of the extreme drought and fire outbreaks in the grain powerhouse state of Mato Grosso, one of the hardest-hit states, which alone contributes to the national agricultural output with nearly 30% of soya bean output and over 40% of the national corn production, is delay to the start of sowing. Traditionally, it commences in early September, but it has been postponed due to the dry weather and lack of rain, exerting further financial pressure on Brazilian farmers already grappling with a substantial price drop.

As most of the country struggles with arid weather and the harmful effects of forest fires on health and the environment, farmers in central Brazil are eagerly awaiting the onset of the wet season, which is not expected in that region before next month at the earliest, according to the latest agroclimatologic bulletin by the National Institute of Meteorology (Inmet).

Rainfall is anticipated in the South and Southeast regions over the next few weeks. Meanwhile, Central-West states, including Mato Grosso, will continue facing high temperatures and overdry weather without significant rain until at least October. Inmet predicts low relative humidity, plummeting air quality and above-average temperatures will continue all over central Brazil in the coming months. The persistence of dry and hot air masses diminishes soil water levels and favours the outbreak of fires.

It remains to be seen to what extent the ongoing dryness and wildfires will influence the planting and development of the soya bean and other crops across drought-stricken producing states and their shifting through the Northern Arc ports in the following months. These challenging weather and climate patterns could complicate the otherwise optimistic outlook of the Brazilian and American federal agricultural agencies.

Please read our disclaimer.

Related topic:

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br