Understanding Shortage Allowances

read more

Brazilian and US agricultural agencies reiterate forecast of record-breaking agricultural production in Brazil, particularly for soya beans

The National Supply Company (CONAB) projects a harvest of nearly 316 million metric tons (mmt) of grains in the 2022/23 season, an increase of almost 16% in relation to the estimate of the past drought-affected cycle, leading the country to break another production record, reaffirming agribusiness as the leading driving force sustaining Brazil’s trade balance surplus.

As in recent seasons, the soya bean stands out with the highest growth in the current crop. With its harvest practically finished (99.9%), CONAB estimates an unprecedented volume of 155.7 mmt, 24% above last season’s output, around 30.2 mmt more harvested.

For corn (maise), the federal agricultural agency estimates a new record crop of 125.7 mmt, 11% above the volume produced in 2021/22. Other agricultural products with significant production increases include cotton and wheat.

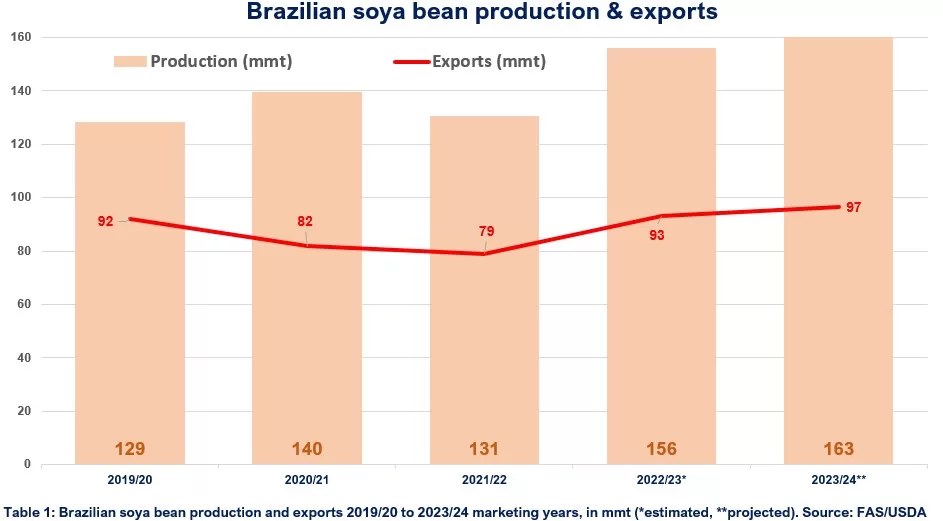

Soya bean in bulk is Brazil’s top commodity in the export basket in FOB value (US$ 46.6 billion in 2022) and is second only to iron ore in gross weight (78.7 mmt). The latest estimates from regulatory bodies and the sector maintain the country as the world’s largest producer and supplier of this leguminous commodity. (Tables 1 & 2)

The US Department of Agriculture (USDA) forecasts global soya bean harvest for the 2022/23 marketing year at 369.6 mmt, despite the oilseed’s export prices being under pressure compared to the last cycle. With an estimate slightly below that of its Brazilian counterparts, the USDA expects Brazil to produce 156 mmt, followed by the United States (122.7 mmt) and, far behind, Argentina (48 mmt), whose crops were severely affected by drought.

In terms of exports, the US federal agency projects Brazil to ship about 96.5 mmt of soya beans, which comprises over 58% of the estimated 2022/23 global volume (165.3 mmt), well ahead of the US (53.8 mmt), Paraguay (5.7 mmt), and Argentina (3.8 mmt).

China remains the largest global soya bean buyer, with imports in the 2022/23 marketing year estimated at 98 mmt, mostly shipped from Brazil. Other relevant importers of the oilseed include the European Union (13.9 mmt), Argentina (8.7 mmt) and Mexico (6.4 mmt).

For the 2023/24 harvest, the prospects of federal agricultural agencies are even more optimistic for Brazilian soya beans, with a production volume of 163 mmt, 96.5 mmt of which are destined for export. (Table 1)

Brazil is the third-largest crusher after China and the United States, directing around half of its soya bean meal production for domestic consumption, with the biggest buyers being EU countries. For 2022/23, the output is forecast at 41.5 mmt, 5.5% above the previous season, while the projection for 2023/24 is 43.2 mmt, up 4% from the current season.

Second only to Argentina in the export of soya bean meal (seed cake), Brazil is expected to sell 21.7 mmt in 2022/23, an increase of 7% compared to the past crop and approximately the same number for the next cycle.

The country lags behind China and the US in soya bean oil production and is the second-largest exporter of this commodity, with India being the largest importer. Brazilian soya bean oil output for 2022/23 is forecast at 10.3 mmt, a 5.5% increase over last season, with 10.7 mmt projected for 2023/24. Meal exports in 2022/23 are estimated at 2.4 mmt, the same level as last and next season.

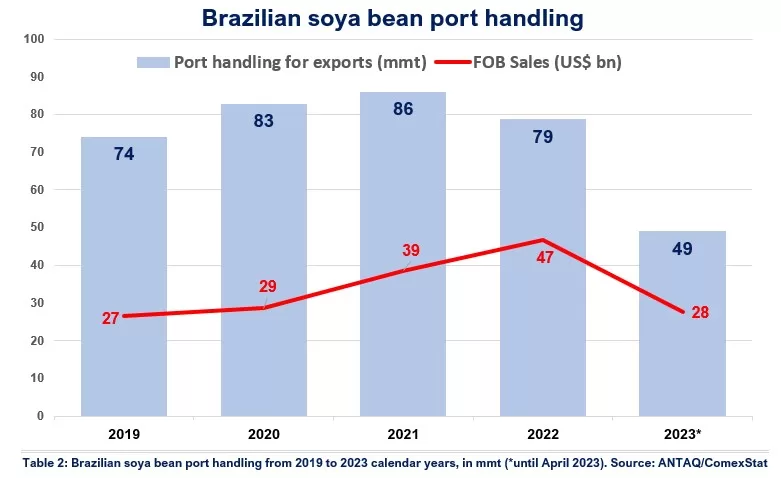

After a steady increase over the last decade, in 2022, the amount of soya bean shipments departing Brazilian ports dropped by 9.6% compared with the previous year. However, the upcoming bumper crop will likely offset this fall.

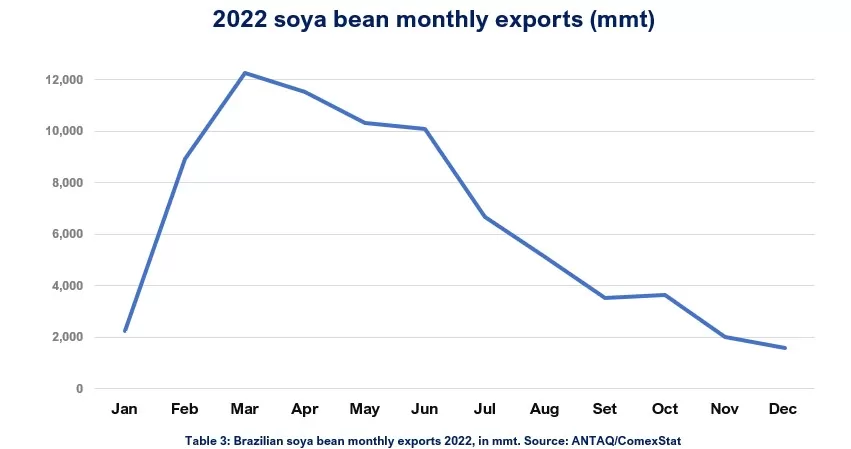

According to statistics by the National Agency of Waterway Transport (ANTAQ), 78 mmt of soya beans in bulk were shipped abroad in 2022, with about 11.3 mmt of that volume carried from barge transhipment stations to maritime ports on convoys on the Amazon inland waterways. Soya bean shipments peaked from late February to early July. (Tables 2 & 3)

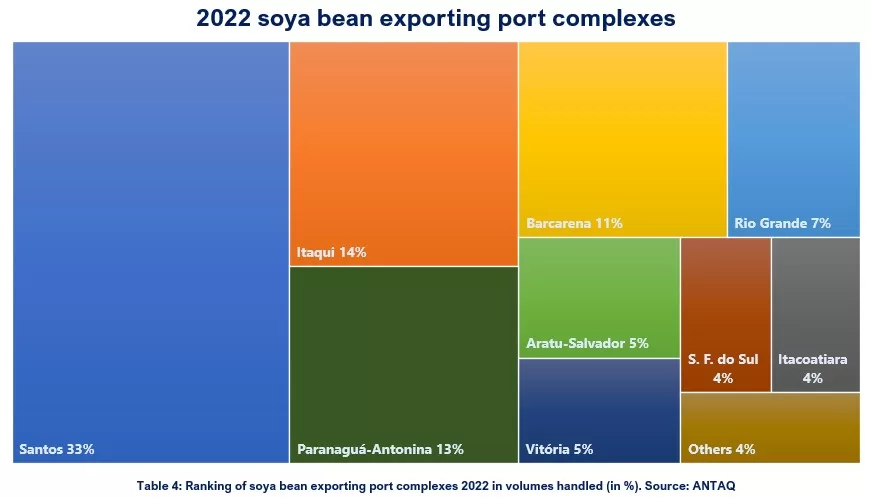

The main exporting port complexes last year were Santos, with 26 mmt (33%), followed by Itaqui, with 11.3 mmt (14%), Paranaguá-Antonina, with 9.8 mmt (13%), and Vila do Conde-Barcarena, with 8.9 mmt (11%).

The Northern Arc ports, comprising Aratu/Salvador, Itaqui, Vila do Conde/Barcarena, Macapa/Santana, Santarem and Itacoatiara, increased their share in exports, moving together nearly 30 mmt of soya beans, 38% of all shipments of 2022. (Table 4)

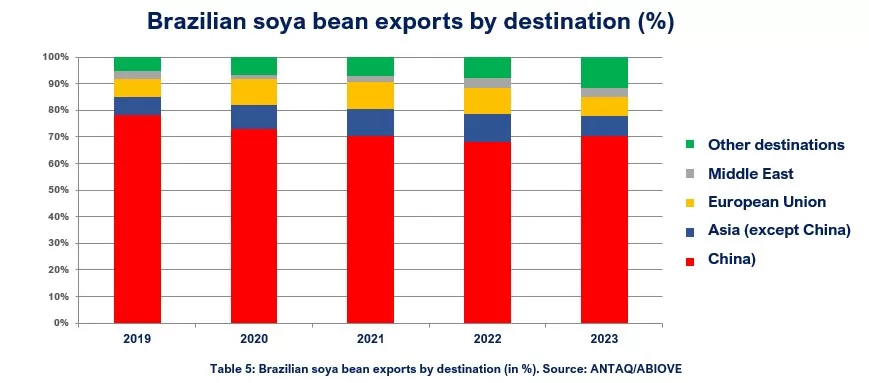

As in recent years, China remains comfortably the leading destination of the oilseed, having received 53.8 mmt of soya beans, which comprises 67% of all shipments from Brazil in 2022. Until May this year, China’s share of imports rose to 70%, with the Asian country buying 34.4 mmt of the 49 mmt of the product shipped thus far. (Table 5)

Last year, MAPA presented a draft for a full revision to the official soya bean grading standards, creating new groups and subtypes and reducing the moisture content from 14% to 13% to align this limit with major players such as the United States and China.

The proposed changes are still being discussed by the Brazilian federal agricultural authorities and sectors of the industry, and this article explains the main proposed changes.

The federal agricultural agency maintains its projections for 2022/23 with high expectations, mainly soya beans and corn, whose exports are expected to break records this and next season. However, the recent depreciation of the Brazilian currency against the US Dollar and external factors such as the US crop, which weather conditions may still adversely impact, and the Chinese market demand will influence the price and supply of the commodity.

Brazilian ports will continue to be busy handling soya beans in the coming years. The Northern Arc ports are projected to expand their share of soya bean exports, particularly from the north of Mato Grosso and the northern states, as new loading facilities enter into operation and the storage capacity of local grain elevators is increased.

In fact, the expectation for the next decade is promising. According to the study “Projections of Agribusiness, Brazil 2021/2022 to 2031/2032”, carried out by MAPA together with the Secretariat of Intelligence and Strategic Relations of the Brazilian Agricultural Research Corporation (Embrapa) and by the Department of Statistics of the University of Brasília (UnB), Brazilian soya bean production is poised to reach about 180 mmt in 2031/2032, a growth of 15% in comparison with the estimate for the 2022/23 cycle, with exports reaching 115 mmt. The expansion reflects an expected increase in planted area and enhanced productivity with the application of advanced farming technology.

Please read our disclaimer.

Related topics:

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br