Dengue cases and deaths soar to record levels

read more

Agricultural production in Brazil in 2020/21 was affected by a severe drought that delayed soya bean sowing and badly hit the maize (corn) crop. Nevertheless, soya bean output went from 128.5 million metric tons (mmt) in 2019/20 to a record 137 mmt for this crop, according to recent data from the US Department of Agriculture (USDA).

Despite increased production, soya bean exports dropped 11.3%, from 92.1 mmt in the past season to 81.7 mmt in 2020/21.

According to the USDA, the global supply of the leguminous oilseed in 2022 will reach an unprecedented volume of 385 mmt, with Brazil accounting for more than a third of all world production. Exports are forecast at a record 173 mmt, with the country shipping more than half of the global exports.

By early October, the planting of the 2021/22 soya bean crop in Brazil had reached about 10% of the estimated area, 3% higher than in the same period of the previous season, boosted by rains in most of the planted areas, notably in the powerhouse grain states of Mato Grosso and Paraná.

The USDA forecasts that Brazil’s soya bean production for the 2021/22 marketing year will reach a record high of 144 mmt, a 5.1% increase. Exports, in turn, are predicted to rise a staggering 14% compared to the last marketing year, from 81.7 mmt to 93 mmt, making it another record export season.

Brazil’s National Supply Company (CONAB) reports that despite the uncertainties brought about by the La Niña phenomenon and the increase in the costs of agricultural inputs, such as fertilisers, pesticides and seeds, the soya bean area should grow 2.5% compared to the previous crop, reaching 39.9 million hectares. With a more conservative forecast than the US agricultural agency, CONAB expects national soya bean output to reach 140.7 mmt, while exports should be around 87 mmt in 2021/22, with China remaining by far the leading buyer of the Brazilian oilseed.

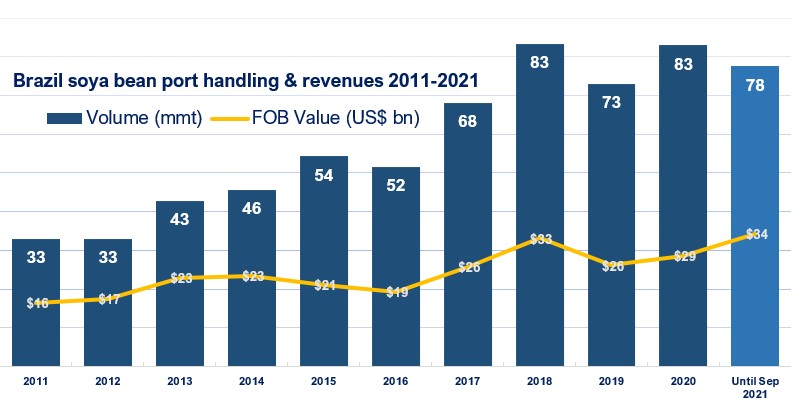

Data from the Secretariat of Foreign Trade (SECEX) indicates that between January and September 2021, 77.5 mmt of soya beans FOB valued at US$ 34.3 billion were shipped from Brazilian ports, keeping the oilseed on the top of the ranking of agriproduct exports. Although the volumes exported so far had a slight decrease of 1.7% year on year due to a late start this exporting season, profits went up impressive 27% compared with the same period of last year, boosted by a favourable exchange rate.

The leading exporting ports were Santos, loading 28% of the soya beans, followed by Paranaguá (15%), Itaqui (12%), Rio Grande (5.5%), and São Francisco do Sul (5%). At this time of the year, exports peak up at the Northern Arc ports, particularly at the grain elevators of Barcarena, Itacoatiara and Santarém.

Standard soya beans contracts drafted by the Brazilian Association of Grain Exporters (ANEC), the most used in Brazilian FOB shipments, specify a maximum moisture content (MC) of 14%, in line with recommendations issued by the Brazilian Ministry of Agriculture (MAPA). On the other hand, P&I clubs and cargo scientists perceive this limit as far too high. They warn that soya beans with excessive MC and high temperature are biologically unstable and prone to self-heat during sea passage, especially on the long hauls between South America and Southeast Asia, where three-quarters of the oilseed is exported.

Despite positive production and export prospects for the coming season, higher moisture levels in soya beans can be expected if CONAB’s forecast for rain during harvesting time due to the La Niña is confirmed.

Our publication Loading Soya Beans in Brazil – Practical Guidance provides detailed information on this commodity.

Please read our disclaimer.

Related topics:

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br