Visa exemptions for certain nationalities rei...

read more

Producers strongly oppose the stricter moisture limit the Ministry of Agriculture proposes to include in a new soya bean technical regulation

Agricultural commodities have accounted for about a quarter of Brazil’s exports in recent years and have been decisive in maintaining the country’s positive trade balance. Last year, the thriving Brazilian agribusiness exported almost 25% more products than in 2022, with soya bean and corn shipments standing out.

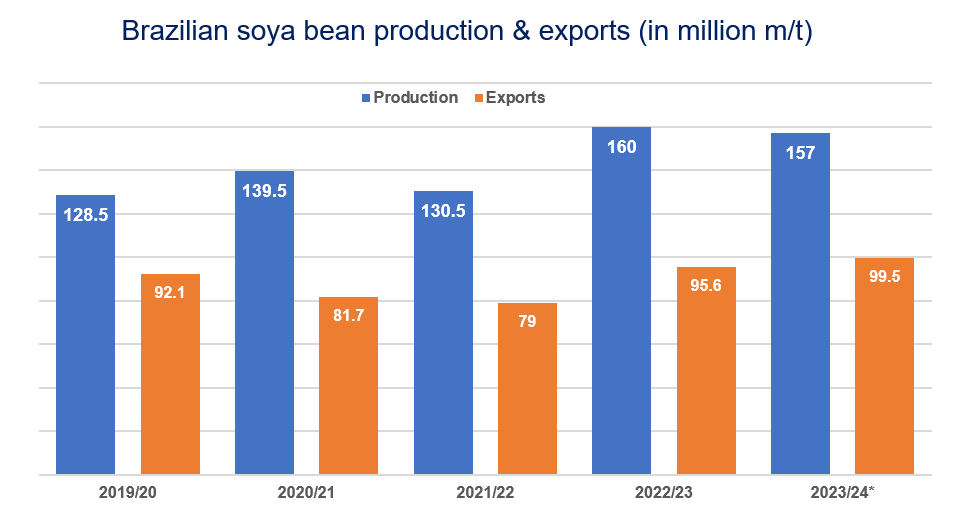

Brazil reached record figures in soya bean production and exports in the 2022/23 marketing season. As the 2023/24 sowing nears completion, the country is bound to maintain very high levels and continue comfortably reigning as the world’s largest oilseed supplier, followed by the United States and a recovering Argentina.

Against this backdrop, as reported in this article, the Ministry of Agriculture, Livestock and Supply (MAPA) seeks to reformulate its soya bean technical regulation (Normative Instruction 11 of May 2007, known as IN 11/2007, as amended) to align it with national grading standards adopted by other major global oilseed players, notably China and the United States. However, a crucial point of divergence is the proposed reduction of the moisture content limit.

The review of the soya bean regulation, introduced by Ordinance SDA 532 of February 2022, provides for the stratification of the product into different types and changes the limits of defects and moisture, protein and oil content, among other qualitative parameters.

Private sector associations linked to farmers, processors and exporters are discussing the proposed changes with MAPA and other actors in the sector.

While most of the revised limits and innovations have been generally well received across the oil and grain industry, MAPA’s plan to lower the moisture content (MC) limit from 14% to 13% has met much resistance among producers and became the central point of disagreement of the draft regulation.

During recent public hearings, producer unions eagerly defended maintaining the current 14% tolerance, claiming that farmers will have to bear higher production costs and lower profits that the MC reduction will generate without fair compensation.

From October to November 2023, MAPA and other government officials held a series of public hearings with producers and representatives of the oil and grain industry to explain and discuss the draft proposal under Ordinance SDA 532.

Grain processors and traders advocated reducing the MC to 13%, arguing that this could save logistics and storage costs with a considerable increase in the shelf life, further enhancing the quality of the bean and increasing the already high competitiveness of the product in the global oilseed market.

On the other hand, representatives of agricultural confederations and producer cooperatives voiced their concerns and objections to the proposed reduction. They contend that for every percentage point down, there is a mass loss of 1.15%, with cuts in sales revenue corresponding to around 3 million tonnes. The change would only be acceptable to producers if financial compensation mechanisms were introduced.

In December 2023, the Agriculture, Livestock, Supply and Rural Development (CAPADR) of the Chambers of Deputies (lower house of the Brazilian National Congress) held an extraordinary meeting in Brasilia to discuss the MAPA proposal, more specifically in what it concerns the stricter soya bean moisture regime under the new regulation.

During the meeting with parliamentarians, officials representing producer unions and cooperatives again strongly opposed the MC reduction. Conversely, representatives from MAPA, the Brazilian Agricultural Research Corporation (EMBRAPA), grain processors and exporters plainly favoured the change.

The opposing sides presented their cases and discussed the pros and cons of the MC limit reduction in line with the recently revised Chinese standard of 13%. Unsurprisingly, consensus was not reached, and discussions with stakeholders are expected to continue throughout this year.

It is well known in the shipping industry that the soya bean is prone to developing microbiological deterioration and self-heating if its moisture content and temperature exceed certain levels. The effects of this inherent vice are considerably aggravated on long-haul passages, such as shipments bound for Asian countries, which can take more than 40 days to arrive, in addition to the time needed to shift the cargo from post-harvest storage to the loading port, load it on board, wait for a berth at the destination, unload and transport it to importers’ facilities.

As China has been buying about three-quarters of all Brazilian soya beans exports lately, shipowners and their P&I insurers are concerned about the long transit time involved and the high tolerance for moisture content afforded under the current national standard, which leads to spoilage and often translates into cargo claims against sea carriers. They would, therefore, welcome the proposed change in the moisture limit.

Almost all soya bean shipments from Brazil are covered by standard sales contracts drafted by the Brazilian Association of Grain Exporters (ANEC), in the form of ANEC 41 (FOB contract for parcels) and ANEC 42 (FOB contract for full cargo). Both standard contracts specify a moisture content limit of 14%.

MAPA’s regulation, in turn, requires MC determination but does not make it mandatory in foreign trade, except when the Brazilian government is the seller or buyer or if the oilseed has been imported for fresh human consumption. Nevertheless, although that regulation does not apply to private export transactions, ANEC 41 and ANEC 42 contracts determine that IN 11/2007 or “any further revision or replacement of these regulations in force at time of loading” must be applied as the grading standard.

Those advocating in favour outline the lower moisture content’s benefits, including reduced metabolic activity, natural heating, bean breakage, microflora activity and storage losses. However, even though producers are generally aware of the benefits it would ensue to storability and outturn quality of the soya bean, they understand the change will directly impact the mass and volume of the product to the detriment of the farmers’ revenues and net profits.

In other words, with a 13% MC, more beans will be needed to reach the same gross weight. In this scenario, in the producers’ view, only grain processors, sellers and buyers would ultimately benefit from the positive impacts a lower MC would have on the conservation and quality parameters of the commodity, including a higher protein and oil content.

Unquestionably, a single one per cent reduction in the moisture content of soya beans would positively influence the quality and competitiveness of the Brazilian product and reduce the incidence of losses during storage and transportation, particularly on the Brazil-China maritime route. But again, producers expect that, in return for their investment in delivering a higher-quality product, there will be compensatory schemes to bring a financial equilibrium across the entire supply chain.

There is no deadline for a decision on the final draft of the new regulation. Still, a definition is expected later this year or earlier, depending on the pressure buyers exert during the 2023/24 season. Likewise, whether Ordinance SDA 532 will come into force immediately or if there will be a grace period for its implementation remains to be told.

Please read our disclaimer.

Published 19 January 2024. Updated 22 January 2024.

Related topics:

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br