Crackdown on shipboard A/C at Amazon ports

read more

It was the first-ever confirmed case of highly pathogenic avian influenza within Brazil’s commercial poultry sector, which comes as the virus has been circulating in Asia, Africa, and Europe since 2006

On 16 May 2025, just as Brazil set a new poultry export record in the face of growing global demand and tariff disputes, the Ministry of Agriculture, Livestock, and Food Supply (MAPA) announced the first-ever detection of highly pathogenic avian influenza (HPAI) virus on a commercial farm in the country. The case was detected at a commercial poultry breeding facility in the town of Montenegro, located approximately 60 kilometres from Porto Alegre, in the southernmost state of Rio Grande do Sul. In response to this incident, a 60-day animal health emergency was declared.

MAPA has assured consumers that avian flu cannot be transmitted through the consumption of poultry meat or eggs; therefore, there are no restrictions on the consumption of these products. The federal agricultural authority also emphasised that the risk of human infection remains low and is generally associated with direct and prolonged contact with infected birds, either alive or dead.

In line with the National Contingency Plan for Avian Influenza, MAPA has implemented measures for containment and eradication. The federal authority has engaged with stakeholders and trading partners across the poultry production sector, notifying the World Organisation for Animal Health (WOAH) and other international regulatory bodies about the developing situation and the initiatives being undertaken.

Currently, sanitary barriers have been set up, and inspections are being conducted at poultry facilities within a 10-kilometre radius of the outbreak in Rio Grande do Sul. Vehicles and conveyances are being cleaned and disinfected before being allowed to leave the designated area. So far, only one suspected case has been identified during these inspections. All poultry and eggs on-site have been culled for proper disposal, and thorough cleaning and disinfection procedures are underway according to established protocols, which also include sampling the suspected case for laboratory analysis.

Additionally, an investigation is ongoing at poultry farms in the northern state of Tocantins, where the presence of influenza A has been identified; however, MAPA assessed that the likelihood of this virus being a highly pathogenic strain is low. The federal authority has affirmed that Brazil’s veterinary services are well-trained and equipped to manage these outbreaks effectively.

Brazil is the world’s largest exporter of fresh and processed chicken and the third-largest producer, behind the United States and China. In recent years, the Brazilian poultry sector has benefited from the opening of new markets and the expansion of existing ones. Data from Brazil’s Foreign Trade Secretariat (Secex) indicates a continuous surge in Brazilian exports of poultry products over the past five years, with volumes increasing by 24% and revenues increasing by 40% in this period. Last year, poultry exports reached record highs in both gross weight and FOB sales. Figure 1

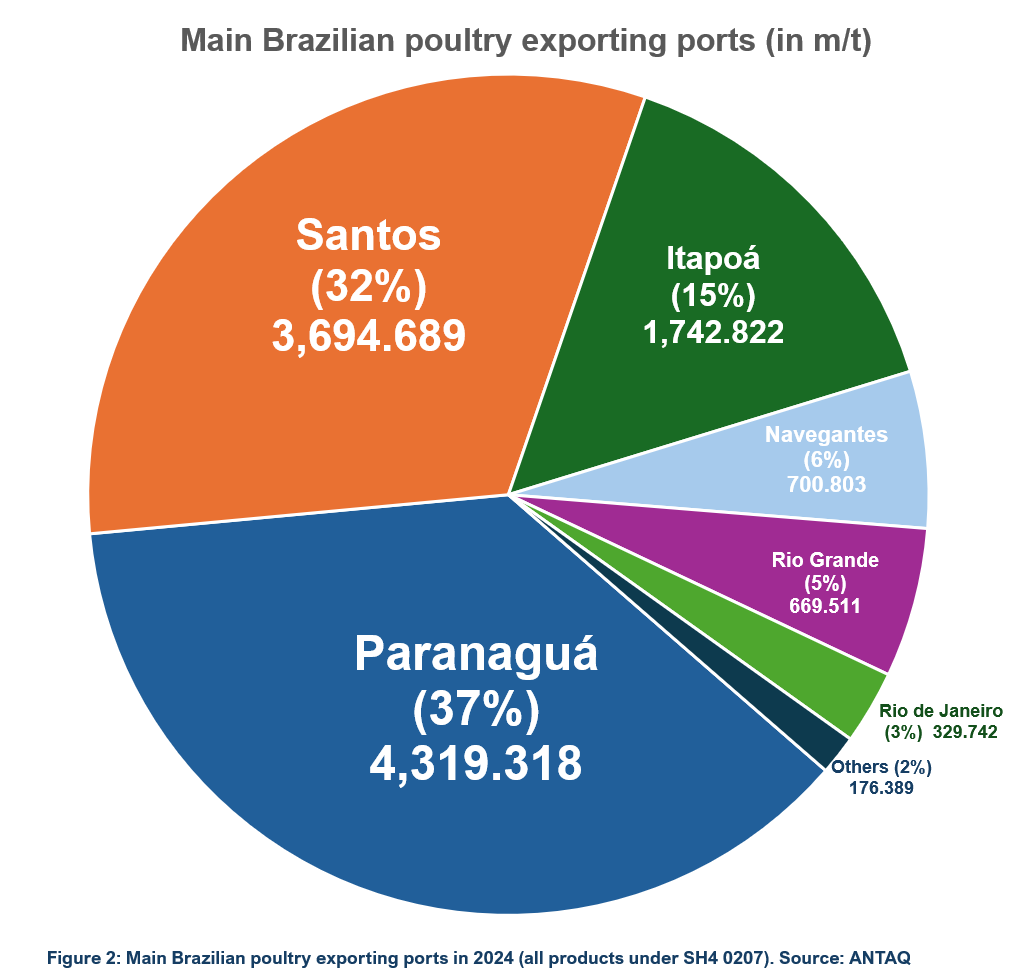

In 2024, most Brazilian poultry shipments originated from the ports of Paranaguá, Santos, Itapoá, Navegantes, Rio Grande, ports in the southern states of Paraná (Paranaguá), Santa Catarina (Navegantes, Itajaí, Itapoá, São Francisco do Sul), and Rio Grande do Sul (Rio Grande and Porto Alegre). Poultry exports, typically in 40’ refrigerated containers, were shipped to 172 different countries, with the top destinations being ports in China (14% of shipments), the United Arab Emirates (10%), Japan (9.3%), Saudi Arabia (9.1%) and Mexico (6.2%).

Until April of this year, Secex recorded poultry exports totalling 1.7 million metric tons, representing a 9.1% increase compared to the same period of the previous year, with FOB sales reaching US$3.1 billion, reflecting a 13% rise in revenues. Before the animal health emergency was declared, primary buyers of Brazilian poultry during the ongoing export season included China (15% of sales), Saudi Arabia (11%), the United Arab Emirates (9.7%), Japan (7.5%), and Mexico (5.4%). This ranking might change due to potential full or partial bans.

In line with established international sanitary protocols, following the Ministry of Agriculture’s official announcement, several traditional importing countries – including China, members of the European Union, Mexico, Argentina, Chile, and Uruguay – temporarily banned Brazilian poultry products. Other major importers are expected to follow suit. In contrast, some major buyers of Brazilian chicken, such as Japan, will impose limited restrictions on products originating from farms in the region of Montenegro.

While poultry exporters have not provided specific figures for anticipated commercial losses from the ban, industry experts and government officials estimate that the losses could reach as much as $250 million per month, affecting approximately 150,000 tonnes of monthly shipments. Long-term projected losses could range from $500 million to $1 billion over the next 12 months.

It is too early to assess potential job losses in the poultry sector, which will nevertheless continue to supply the domestic market with poultry meat and eggs. Brazilian authorities and farmers are actively working to resolve the situation and restore the country’s HPAI-free status. Yet, there is currently no specific timeframe for lifting the temporary export restriction.

Ultimately, the speed at which exports can resume –and the impact of the ban on the domestic economy, trade balance, and Brazil’s competitive position in the global poultry market – will depend on how quickly stakeholders and authorities can address this incident and rebuild trust with trading partners.

Please read our disclaimer.

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br