Dengue cases and deaths soar to record levels

read more

Brazilian grain production in the 2022/23 season should reach about 311 million metric tons (mmt). The volume represents an increase of nearly 15% compared to the previous crop, according to the latest assessment by the National Supply Company (CONAB)

The estimate is slightly lower than the last survey due to adverse weather in some key producing regions in the south of the country. Yet, agricultural production is still forecast at an all-time high, driven mainly by record-breaking soya bean, corn and wheat crops.

Production

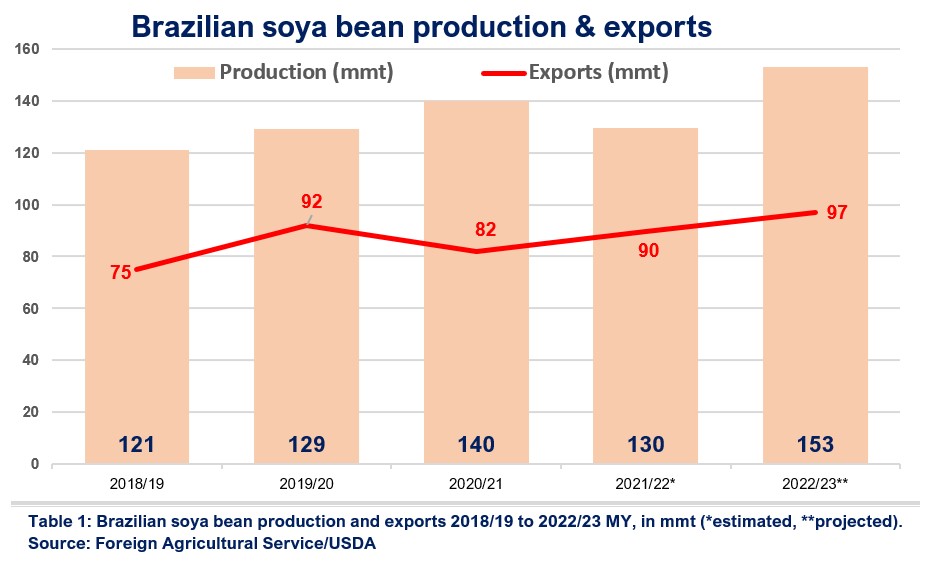

The Soya bean harvest is nearing completion, with an expected yielding of 153 mmt, up 22% from last season, despite adverse weather conditions in Rio Grande do Sul and Paraná, where consistent rainfall is needed so as not to negatively impact soya bean and corn outputs in these states.

If CONAB’s forecast is confirmed, soya bean will break a new production – and export – record, keeping Brazil as the world’s largest producer and supplier of this oilseed. Currently, the country is the third-largest global supplier of soya bean meal and soya bean oil after China and the United States.

The US Department of Agriculture (USDA) forecast for Brazilian soya bean production is the same as that of CONAB, with the US yielding 116 mmt and the Argentinean soya bean crop shrinking to around 45.5 mmt.

Soya bean exports

Brazil sold 79 mmt of soya beans worth US$ 47 billion in 2022, chiefly to China, keeping the oilseed as the leading commodity in the country’s export basket in FOB revenue, followed by oil and its derivatives and iron ore, second only to iron ore in terms of gross weight.

The Federal Agency of Waterway Transport (ANTAQ) indicates that from January to October 2022, around 74 mmt of soya beans in bulk have been shipped in Brazilian ports, 14% less than the previous calendar year. The main soya bean exporting port complexes during this period were Santos (34% of volumes), followed by Itaqui (15%), Paranaguá-Antonina (12.3%), Vila do Conde-Barcarena (11.8%), and Rio Grande (6.5%).

For the 2022/2023 marketing year, both CONAB and the USDA estimate Brazilian soya bean exports at 97 mmt, 8% more than the previous season, topping the export record set in 2019/2020. Table 1

Soya bean planted area has expanded for the 2022/23 season, and global demand is expected to keep rising, particularly if China, the world’s top importer of oilseeds, effectively phases out its Zero-COVID policy.

Even though soya bean shipments were down compared to 2021, soya bean products have hit record levels making Brazil second only to Argentina as the largest global supplier of soya bean meal and oil. Soya bean meal exports amounted to 16 mmt, up 28% year on year, departing mostly from Santos, Paranaguá and Rio Grande, while soya bean oil exports was 2.6 mmt, 85% more volumes than 2021, shipped mainly from liquid bulk terminals in Paranaguá, Rio Grande, and São Francisco do Sul.

Production

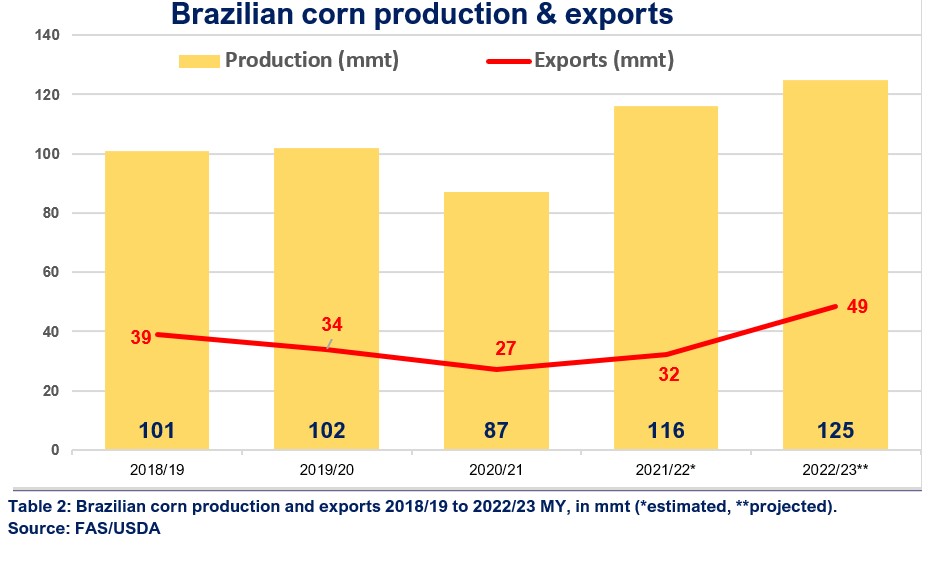

Brazilian and US federal agricultural agencies expect corn production to reach a record 125 mmt, an 8% rise over the previous cycle, the third-largest world corn production after the United States and China.

Corn exports

Preliminary data from the Ministry of Economy indicates that last year Brazil exported 43 mmt of corn in bulk FOB valued at US$ 12.3 billion.

From January to October 2022, corn shipments departing Brazilian ports exceeded 30 mmt, more than doubling the volume exported in the same period of 2021. The main corn exporting port complexes were Santos (36%), Vila do Conde-Barcarena (21%), Paranaguá-Antonina (13%), Itaqui (12%) and Santarém (8%).

The Brazilian federal agricultural agency estimates that corn exports for 2022/23 will reach around 45 mmt, almost 17% more than last season. The USDA, in turn, projects an optimistic 48.5 mmt for this marketing year, behind only the US, whose exports are forecast at around 51 mmt. Table 2

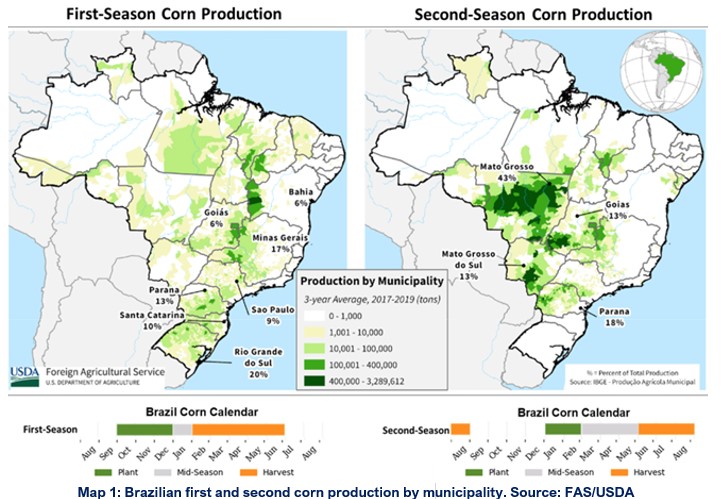

The cereal grain remains the second agricultural product exported by Brazil in volume and revenue after the soya bean. It is grown almost the entire year in three crops. The first season is typically planted between August to December and harvested between January and June, depending on the region, starting from the south upwards. The safrinha (little crop, in Portuguese), as the second season is known, is usually planted between December to March, after the soya bean harvest. Despite its diminutive nickname, it accounts for roughly three-quarters of the total corn production, with emphasis on the powerhouse state of Mato Grosso. A third, off-season crop, with modest yield rates, is planted in some states in the North and Northeast regions, where sowing takes place around May and harvesting in October Map 1

Although the increase in demand in the domestic and international markets and rising prices have stimulated the planting of corn, the unstable production costs led some producers to migrate to more profitable crops, such as soya beans.

Besides the booming soya bean and corn crops, Brazilian agribusiness is heading towards a record wheat production in the 2022/23 season, which registers an increase of 27% and 13% in output and harvested area, respectively, compared to the past cycle.

Cultivated chiefly in the southern states of Paraná and Rio Grande do Sul, wheat has been gaining the attention of growers who have been increasingly expanding the harvested area and investing in production and exports to lessen dependency on imports of the grain. Argentina traditionally supplied over 80% of the country’s imports, the fourth-largest global importer of this cereal.

From January to October 2022, wheat exports amounted to 1.5 mmt, up 133% year on year, while imports reached 3.9 mmt, down 27% from the same period in 2021.

Please read our disclaimer.

Related topics:

Rua Barão de Cotegipe, 443 - Sala 610 - 96200-290 - Rio Grande/RS - Brazil

Telephone +55 53 3233 1500

proinde.riogrande@proinde.com.br

Rua Itororó, 3 - 3rd floor

11010-071 - Santos, SP - Brazil

Telephone +55 13 4009 9550

proinde@proinde.com.br

Av. Rio Branco, 45 - sala 2402

20090-003 - Rio de Janeiro, RJ - Brazil

Telephone +55 21 2253 6145

proinde.rio@proinde.com.br

Rua Professor Elpidio Pimentel, 320 sala 401 - 29065-060 – Vitoria, ES – Brazil

Telephone: +55 27 3337 1178

proinde.vitoria@proinde.com.br

Rua Miguel Calmon, 19 - sala 702 - 40015-010 – Salvador, BA – Brazil

Telephone: +55 71 3242 3384

proinde.salvador@proinde.com.br

Av. Visconde de Jequitinhonha, 209 - sala 402 - 51021-190 - Recife, PE - Brazil

Telephone +55 81 3328 6414

proinde.recife@proinde.com.br

Rua Osvaldo Cruz, 01, Sala 1408

60125-150 – Fortaleza-CE – Brazil

Telephone +55 85 3099 4068

proinde.fortaleza@proinde.com.br

Tv. Joaquim Furtado, Quadra 314, Lote 01, Sala 206 - 68447-000 – Barcarena, PA – Brazil

Telephone +55 91 99393 4252

proinde.belem@proinde.com.br

Av. Dr. Theomario Pinto da Costa, 811 - sala 204 - 69050-055 - Manaus, AM - Brazil

Telephone +55 92 3307-0653

proinde.manaus@proinde.com.br

Rua dos Azulões, Sala 111 - Edifício Office Tower - 65075-060 - São Luis, MA - Brazil

Telephone +55 98 99101-2939

proinde.belem@proinde.com.br